At Berkshire Hathaway’s annual shareholders conference this past weekend, Warren Buffett took the stage, as he has for the past 60 years, to regale the audience on everything from his firm’s performance and macroeconomics to life advice and grandfatherly wisdom. He’s formally stepping down at the end of this year and passing the reins to Greg Abel.

I will miss reading and hearing from Buffett on an annual basis. A few years ago I even purchased a few shares of Berkshire stock (Series B . . . Series A was a little pricey and currently trades around $775,000 per share as of this writing). My plan was to travel to Omaha for the “Woodstock of Capitalism” and hear from Buffett in person, but I may have missed my chance.

Regardless, we’ll always have Buffett’s eternal wisdom, some of which I tried to capture following previous shareholder meetings over the past few years. And if you’re still not convinced, here’s why you should always read Buffett’s shareholder letters (or go back and read his old ones).

In this year’s meeting, I was most interested to hear Buffett’s thoughts on tariffs (which I’ve written about previously). The Trump administration just hit the symbolically consequential 100 days mark and it’s been a tariff-fueled roller-coaster (to say the least) in global financial markets.

Buffett even penned an article for Fortune Magazine in 2003 related to tariffs and the trade deficit. He proposed what he described in this year’s meeting as a “gimmicky” scheme to address America’s mounting trade deficits with “import certificates.” The idea was never implemented, but Buffett emphasized in this year’s meeting — it was far from the trade weaponization that’s happening today.

Buffett was exploring a markets-based solution to reduce America’s trade deficit, as opposed to threatening all of America’s trading partners with tariffs. But he missed one key factor in his commentary, which I’ve condensed in the video below. It’s a factor that many Democrats continue to miss and must focus on more if they want to regain power — how the global economy has detrimentally impacted many working class Americans.

Trade should not be a weapon, but America must protect herself from globalization

In his commentary, Warren Buffett emphasized that “trade should not be a weapon.” He was highly critical of tariffs as punishment and of viewing the world through a zero-sum lens. Instead of creating a global economy of winners and losers, Buffett advocated for global prosperity where every country does what they do best and we all trade openly with each other.

This works for many people and it’s certainly benefited America on the whole in the past few decades. America is by practically all metrics the richest country in the world. I challenge you to find a country where it is better or easier to start a business. U.S. equities are still one of the greatest investments globally. And U.S. Treasuries are probably the greatest “risk free” asset in the world.

Many Americans have enjoyed these benefits. But one crucial factor that Buffett missed in his tariff commentary — one that Democrats need to focus on more — is that for all of these benefits that many Americans have enjoyed from a globalized world, there are many Americans who have been left behind.

Working class Americans, in particular, have suffered the consequences of globalization. When America pivoted from an economy that was more agricultural and manufacturing focused to one that offered more professional services and technology, many Americans were left without jobs. Cities in America’s heartland crumbled and decayed.

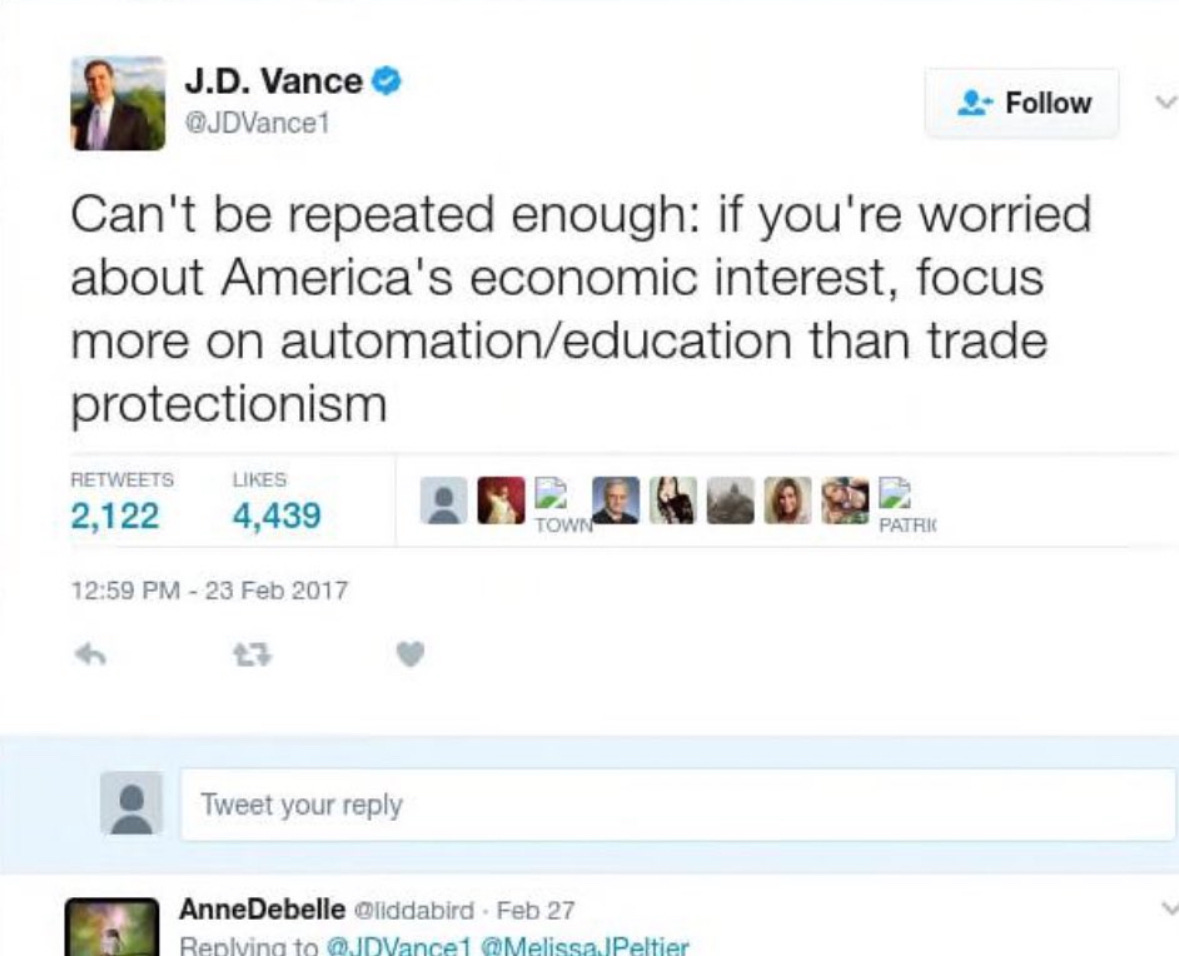

A younger JD Vance wrote about what that life was like in his book, Hillbilly Elegy. He also once had very different ideas on the best solutions to protecting America’s economic interests:

We cannot lose sight of this issue in the discussion over tariffs and weaponizing trade. It’s the reason we are stuck in the trade war discussions to begin with — too many “elites” like Buffett have forgotten about their American working class neighbors for too long.

Yes, globalization has been good on the whole for America. Yes, equities owners like Buffett have become insanely rich over decades of stock ownership. Yes, everyone loves investing in America and financing U.S. debt (for now).

But if the working class or lower class of society suffers while those at or near the top prosper, that doesn’t create economic stability. It sows the seeds of revolution. Which is why someone like Donald Trump looks so appealing to many people who feel cheated or used by the system.

Warren Buffett is right and wrong about trade

In any conversation about globalization, investors like Warren Buffett and anyone else who cares about preserving American democracy cannot forget about its negative consequences. These negative consequences created the conditions for someone to enter the White House with the remit to burn down the existing world order. It created the conditions that empowered people to fight for those who felt hard done by.

Those feelings are genuine. Working class folks are justified in feeling left behind while the globalized world and those who operate in it prosper. America has not deployed sufficient resources to help working families cope with job loss, decimated communities, and decaying cities.

Education, automation, and skills training are all needed to help folks who used to work in manufacturing plants to adapt to a different lifestyle. And that lifestyle must be meaningful to them while also being economically viable.

If we lose sight of that reality in this discussion on trade and the global financial system, we are missing the elephant in the room that put the current administration in power. So while I greatly admire, respect, and mostly agree with Warren Buffett on not weaponizing trade and the dire consequences that can result from creating a world of winners and losers, he’s missing a key factor.

Working class people want to win again in America. They used to view the Democratic Party as their champion and advocate. This was the party of workers’ rights, labor unions, and checking corporate power.

But now many working class folks view the Democrats as highly-educated elitists who will more often overcorrect what people say and how they say it instead of focusing on the issues that truly matter — jobs, wages, housing, community, etc.

In order to change that narrative, Democrats have to acknowledge the plight of working class Americans while also championing the global financial system. Both things can happen simultaneously. Warren Buffett can be right about the benefits of American capitalism while American workers can be right that many other countries took American manufacturing jobs and continue to cheat in international trade.

But the latter reality does not justify weaponizing trade. It doesn’t mean tariffing everyone in the world unless they make concessions and come begging to kiss the king’s pinky ring. It does mean that we Americans must remember those who have been left behind in a globalized world and support those folks with more resources — education, skills training, tax breaks, housing assistance, etc.

This can all be supported by making sure that America remains the primary international trading partner, the dollar keeps its reserve currency status, billionaires pay their fair share in taxes, and everyone has trust and confidence in America’s long term economic prospects.

As Warren Buffett said, we should be striving for global prosperity. That will create a better future for ourselves and our children. But to get there, we cannot forget the many Americans who feel left out or betrayed by the global system. The more we acknowledge and address their plight, the closer we will come to realizing the global prosperity Warren Buffett envisions.

To watch the entire 2025 Berkshire Hathaway annual shareholders meeting, see below:

If you missed my last YouTube video, check it out here:

Here are two great stories we’ve published in The Political Prism by law professor Marcus Gadson:

Have a good week!

This analysis is why the Democratic Party needs to fire its entire messaging team and hire you, John.

I am dead serious.

I would go further here.

The ‘left behind’ narrative often ignores how geography shapes inequality. A software engineer in Nashville thrives while a textile worker in Spartanburg suffers not because of tariffs, but because America lacks a cohesive strategy for place-based investment.

Democrats could reframe the trade debate by stealing a page from Buffett’s playbook: Pitch ‘economic moats’ for workers. Example - Use tariffs temporarily to fund Appalachian microchip factories, with sunset clauses tied to employment targets. Protect people, not just industries.

Still, your closing point is important. Buffett’s vision of global prosperity requires trust, and right now, the working class trusts neither coastal elites nor the factories that abandoned them.

There's several memes floating around the internet depicting Americans working in Asian-like factories, soldering circuit boards and sewing sneakers. I just can't see Americans picking up this kind of work, even if it pays $20 an hour. I don't see the incentive for factories to move back, especially with an unwilling workforce AND such political and possibly social instability.

In other words, the USA is unlikely to go back to more Americans doing drudgery work--even if MAGA says they want that work.